Key Takeaways

- Premier Equity Release Club (PERC) supports advisers in the equity release sector through training, resources, and lender access.

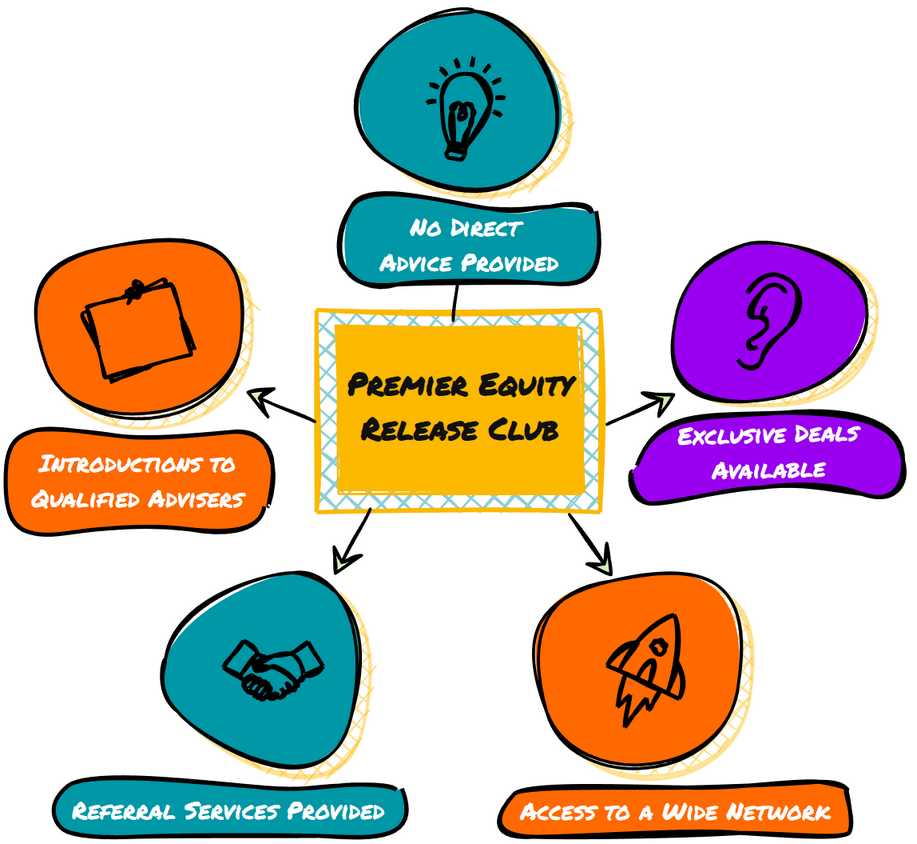

- PERC does not offer direct equity release advice but connects clients with FCA-authorised advisers.

- Clients may gain access to exclusive equity release deals through PERC’s extensive adviser and lender network.

- PERC is not regulated by the FCA, and its role is limited to facilitation rather than direct financial support.

- A free online calculator is available to help clients estimate how much equity they may be able to release.

This article explores the following topics, drawing on our expertise in the field:

Premier Equity Release Club is an organisation that plays a behind-the-scenes but powerful role in the UK equity release market.

Rather than offering loans or advice directly, the firm acts as a bridge—connecting clients with FCA-authorised advisers and giving professionals access to exclusive deals, training, and compliance support.

But could they be the solution you're looking for if you're in the market for an equity release plan?

Read on to find out more.

NB: TimeBank.org.uk is an independent third-party data provider, and the information shared here reflects their views alone, not necessarily those of Premier Equity Release Club. This article is for informational purposes only and should not be considered financial advice or a recommendation to engage with any products offered by Premier Equity Release Club.

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Who Are Premier Equity Release Club?

Premier Equity Release Club (PERC) is an independent organisation in the UK that provides support, training, and resources for advisers in the equity release market.

Their goal is to help advisers navigate the complexities of equity release by offering expert guidance, compliance support, and access to exclusive resources.

Does PERC Offer Equity Release Advice?

PERC is not directly authorised to provide equity release advice but connects advisers and lenders to ensure clients receive the best possible deals.

They also offer training programmes and networking opportunities for professionals looking to specialise in equity release.

What Services Does Premier Equity Release Club Offer?

Premier Equity Release Club (PERC) does not directly provide equity release loans or advice to borrowers.

Facilitation

Instead of offering advice directly, they act as a facilitator, connecting borrowers with qualified advisers and lenders to help them secure the best possible deals.

Here’s how they support prospective borrowers:

- Access to Qualified Advisers: PERC has a network of over 3,000 qualified advisers who can provide guidance on equity release options.1

- Exclusive Deals: By working with advisers and lenders, PERC claims to offer borrowers access to "exclusive deals that may not normally [be obtained] by going to an individual Equity Release Advice firm".2

- Referral to Authorised Advisers: Since PERC is not authorised by the Financial Conduct Authority (FCA) to provide direct advice, they refer borrowers to fully authorised and qualified advisers.3

Equity Release Calculator

PERC also provides a free online calculator to help borrowers estimate how much tax-free cash they could release from their home.4

Benefits of Using Premier Equity Release Club

Benefits of using Premier Equity Release Club include their access to a wide range of advisors and lenders.

Other potential advantages are:

- Fixed Interest Rate & No Hidden Costs: Borrowers can explore lifetime or home reversion mortgages with fixed interest rates and transparent pricing.5

- Large Provider and Adviser Pool: Advisers have direct access to all 10 major lending providers, making it easy to find the best deals for clients. Over 3,200 qualified advisers are available to assist clients.

- Track Record: More than 24,500 clients supported, over £400 million of funds released, and 130+ years of combined industry experience.6

- Positive Client Reviews: An aggregate score of 4,3 (from 11 reviews) on Trustpilot.7

- Industry Recognition: Finalist Best Distributor for Adviser Support at the British Later Life Lending Awards (2025).8

Always remember to weigh the benefits of using a particular service against the potential drawbacks.

Drawbacks to Using Premier Equity Release Club

Drawbacks to using Premier Equity Release Club include the indirect nature of their service.

Other potential cons may include:

- Not FCA-Regulated: PERC is not authorised or regulated by the Financial Conduct Authority (FCA), meaning they do not provide direct financial advice.9

- Adviser Referral: You cannot receive advice directly from PERC; instead, they refer you to a qualified adviser, which may add an extra step in the process.

- Limited Transparency: As a facilitator rather than a lender or adviser, their fee structure and business model may not be as clearly outlined.

- No Direct Customer Support for Equity Release: Since PERC does not provide loans themselves, any queries regarding loan specifics must be directed to individual advisers or lenders.

- Potential Adviser Variability: The quality of advice may differ depending on the adviser you are referred to, as PERC works with a large network of advisers.

Contact Premier Equity Release Club

You can contact Premier Equity Release Club in a few different ways.

These include:

- filling in their online contact form

- phoning them on 0121 296 9987

- emailing them on helpdesk@premiererc.co.uk

- by post: PERC, Ventura Park Road, Tamworth, Staffordshire B78 3HL

Alternatives to Equity Release

Alternatives to equity release are worth considering if you suspect a lifetime mortgage or home reversion plan may not be your ideal solution.

Options include:

- Downsizing: Sell your current home and buy a smaller, more affordable property.

- Using savings or investments: Rely on existing assets to fund retirement needs.

- Borrowing from family: Arrange informal or formal loans from relatives.

- Retirement interest-only mortgages (RIOs): Pay interest monthly, with the loan repaid when the home is sold.

Common Questions

What is Premier Equity Release Club?

How does Premier Equity Release Club help me?

What types of equity release plans can I access through the club?

Is Premier Equity Release Club independent?

How do I know if equity release is right for me?

Conclusion

While Premier Equity Release Club does not offer direct advice or lending, it plays a valuable role in the equity release process by connecting clients with qualified advisers and lenders.

Its broad network, access to exclusive deals, and support for advisers make it a helpful resource for those navigating later-life lending.

However, as it is not FCA-regulated and acts solely as a facilitator, clients should consider the limitations of this model.

Overall, those seeking guidance on later-life borrowing may benefit from the services provided through Premier Equity Release Club.

WAIT! Before You Go…

Equity Release Calculator

How Much Equity Can You Release?